Are Cell Towers Dangerous for Workers? The Real Risk Behind Cell Tower Work in Charlotte, NC

If you climb towers for a living, you already know the danger isn’t just in the height. It’s in the heat, the pressure to finish the job fast, the unpredictable weather, and the lack of oversight that too often puts you at risk. Most people never stop to ask, are cell towers dangerous—but for tower climbers like you, the answer is obvious. Each job site is a potential emergency waiting to happen.

Charlotte and the surrounding areas are growing fast. That growth comes with more towers, more maintenance needs, and more chances for serious workplace injuries. And when something goes wrong, you can’t count on the insurance company to do the right thing. You may find yourself facing high medical bills, lost wages, and a complicated workers’ compensation process—while still dealing with the physical toll of your injury.

This blog breaks down what makes cell tower work so dangerous, what North Carolina law says about workplace injuries like yours, and what to do if the insurance company tries to deny or limit your workers’ comp benefits.

The Hidden Risks of Cell Tower Work in North Carolina

To most people, a cell tower is just part of the background. But if you work on one, you know how dangerous that background can be. Tower climbing is one of the most hazardous jobs in the country—not because of carelessness, but because of the extreme conditions, physical demands, and lack of consistent oversight.

You’re not just working with heights. You’re balancing your body weight on narrow rungs, carrying gear, and troubleshooting electrical components while hundreds of feet in the air. And you’re often expected to do it fast.

What Makes Tower Climbing So Dangerous?

Cell tower workers in Charlotte and across North Carolina face a unique combination of risks every time they’re on a job site. These hazards can result in life-altering injuries or worse.

Some of the most common dangers include:

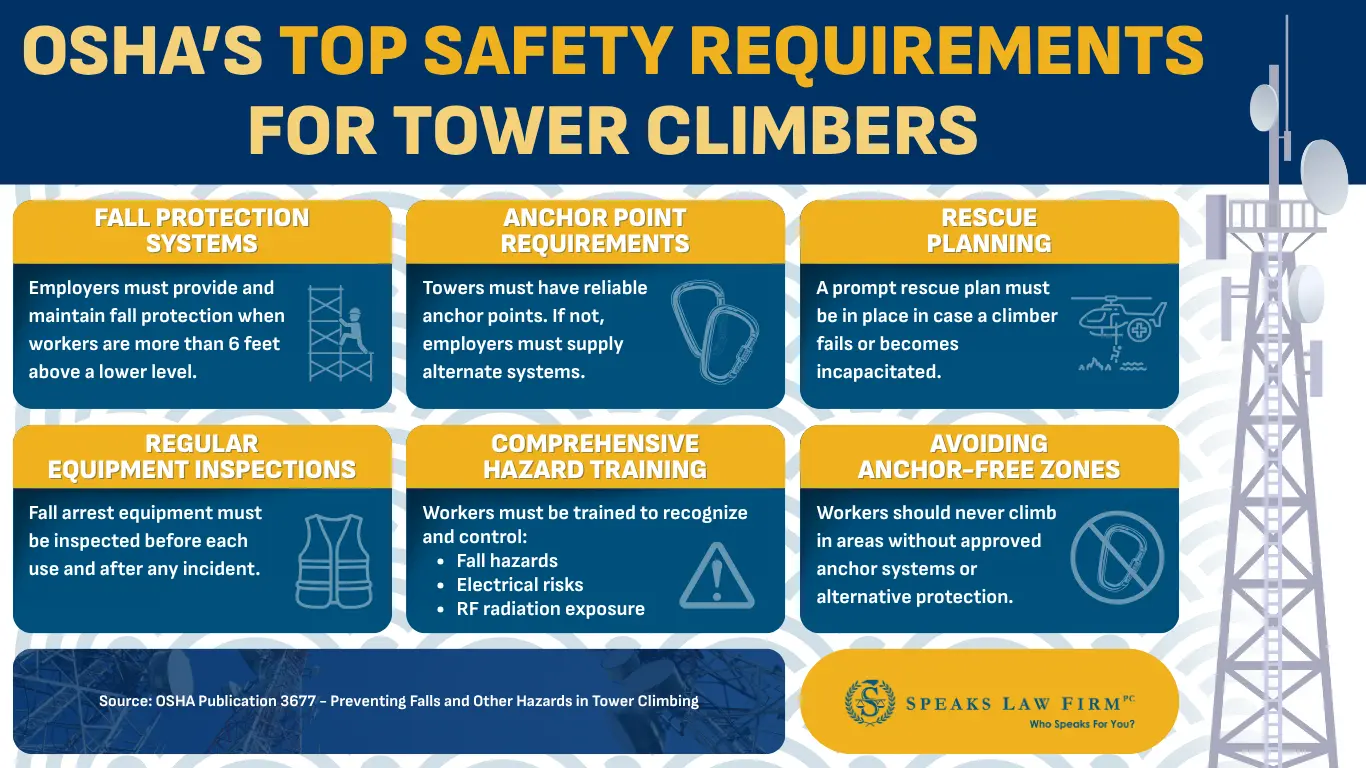

- Falls from Height. Even with harnesses and anchor points, one misstep or faulty clip can send a worker plummeting. OSHA lists fall protection violations as one of the top citations in telecommunications.According to OSHA Publication 3877, “The leading cause of fatalities among tower workers is falls from height, often due to lack of proper fall protection or failure to use it.” Despite this, many climbers are sent up towers without equipment checks, rescue plans, or oversight, especially when subcontractors are rushing to meet project deadlines.

- Electrocution. Many towers are located near high-voltage lines or have exposed electrical components. Contact with energized parts or poor lockout/tagout procedures can be deadly: OSHA Lockout/Tagout Info

- Heat-Related Illness. Working at height means prolonged exposure to direct sunlight and wind, often without shade. Dehydration, heat exhaustion, and heat stroke are serious risks, especially during North Carolina’s hot summer months.

- Structural Failures. Aging or improperly maintained towers can collapse without warning. Rust, metal fatigue, or excessive loading may go unnoticed until it's too late. Some towers, especially older ones, don’t have approved anchor points for fall protection gear. OSHA notes, “Some towers may not have adequate anchor points for fall protection systems. In such cases, alternate protection must be used.” But many workers aren’t told what those alternatives are, or don’t receive them at all.

- Repetitive Stress Injuries. Climbing vertical ladders day after day strains your shoulders, knees, and back. Over time, this can lead to chronic pain, herniated discs, and joint damage.

- Long-Term Occupational Illnesses. While the public debates whether radiofrequency (RF) radiation is dangerous, tower workers may spend hours or days near active antennas without proper safety shutdowns. Prolonged exposure has been linked to symptoms like headaches, nausea, and even neurological effects.

What OSHA Investigations Reveal About Cell Tower Deaths

Behind every OSHA investigation is a real person who didn’t make it home. These aren't isolated events. The pattern is clear: preventable deaths are happening again and again across the cell tower industry, including cases that mirror the work being done every day in and around Charlotte, North Carolina.

OSHA has investigated dozens of communication tower incidents, and many of the reports follow the same devastating blueprint:

- A tower collapses because of poor rigging

- A worker falls during routine maintenance

- A safety harness fails, or worse, was never used

- A climber is electrocuted while repositioning on an active tower

- Weather conditions change fast, and no one called the work off

OSHA has compiled these findings as part of a national effort to reduce fatalities in this high-risk field. Their database is a sobering read: OSHA Communication Tower Incident Investigations

Patterns in Tower Worker Deaths

Many of the incidents OSHA investigated share the same dangerous factors:

- Inadequate fall protection or improper use of safety gear

- Lack of rescue procedures in place when climbers become stranded or unresponsive

- Use of unqualified subcontractors, often with little training or oversight

- Rushed work timelines, especially during network expansions or major storms

- Failure to inspect structural integrity before starting work

In one investigation, two workers died after a tower collapsed during dismantling. The rigging setup failed because no qualified engineer had reviewed the plan. In another case, a worker fell nearly 100 feet while moving between towers—he was not tied off, and no one on the ground could reach him in time.

Lack of rescue planning is another recurring problem. OSHA states: “Employers must provide for prompt rescue of employees in the event of a fall.” But in many incident investigations, tower climbers were stranded or died because no one was prepared to get them down.

These aren’t extreme examples. They reflect real risks that tower climbers like you face, especially in fast-growing cities like Charlotte, where infrastructure is being pushed to expand quickly to meet consumer demand.

How Charlotte’s Growth Increases Risk for Tower Workers

Charlotte’s explosive growth means more towers are going up, often on tight deadlines. Wireless carriers are under pressure to maintain 5G coverage, fill service gaps, and support massive commercial developments. That pressure filters down to the workers climbing towers, sometimes with little sleep, substandard gear, or minimal backup.

Even when safety standards exist, they may not be enforced. Subcontractors hired by larger firms may cut corners to meet production quotas. And when something goes wrong, those same companies may try to deny responsibility, shifting the blame onto the injured worker or refusing to report the incident at all.

That’s why injured tower workers in North Carolina need to take every possible step to protect their rights after an accident. The patterns OSHA found in its investigations show one thing clearly: your job comes with serious risks, and when those risks become reality, the system isn’t always built to support you.

Who Actually Employs Cell Tower Workers?

If you climb towers for a living, chances are you don’t work for AT&T, T-Mobile, or Verizon directly. You probably work for a subcontractor, and you may not even know who ultimately owns the tower you’re servicing. That’s not by accident. The industry is structured in layers, and those layers can make it harder to get answers or compensation when someone gets hurt.

Here’s how the work is usually divided:

The Chain of Command on Most Cell Tower Jobs

- Wireless carriers (like Verizon or T-Mobile) are at the top. They use the towers but don’t usually build or maintain them themselves.

- Tower management companies (such as American Tower, Crown Castle, or SBA Communications) may own or lease the physical tower. They manage leases and contracts but rarely have climbers on payroll.

- Prime contractors are hired by tower owners or wireless companies to complete specific projects. These firms might be regional construction companies or larger national contractors.

- Subcontractors are the companies that employ most tower climbers. These smaller firms are often responsible for the actual labor—installation, maintenance, repair, or inspections.

In many cases, you may work for a subcontractor that reports to a prime contractor, which reports to a tower owner, which reports to a wireless carrier. That’s four layers between you and the company benefiting from your work.

Why That Matters After an Injury

This layered system is designed for speed and scalability, but it also spreads out responsibility. If you get hurt, the prime contractor might blame your direct employer. Your employer might blame the tower owner. And the insurance company may deny your workers’ comp claim altogether, arguing that you weren’t an employee, or that someone else was responsible for the site.

You could be dealing with:

- A subcontractor that doesn’t carry workers’ compensation insurance

- An employer that misclassifies you as an independent contractor

- Multiple entities on the jobsite, each denying responsibility

- Confusion over whether your injury falls under workers’ comp or personal injury law

This also affects training. According to OSHA 3877, tower climbers must be trained to recognize and control fall hazards, electrical risks, and RF exposure. Yet when companies use low-bid subcontractors, this training is often skipped, rushed, or completely undocumented.

That’s why it's not just about who you're working for—it’s about who’s legally responsible when something goes wrong. Let’s look at how North Carolina workers’ comp law applies when injuries happen on these layered worksites.

Who’s Legally Responsible When a Tower Worker Gets Hurt?

Under North Carolina workers’ compensation laws, your employer is responsible for covering injuries that happen on the job, even if another company on the site contributed to what happened. Workers' compensation is a no-fault system, meaning you don’t have to prove your employer did anything wrong. As long as the injury arose out of and in the course of your employment, their insurance should cover your medical treatment and lost income under N.C. Gen. Stat. § 97-2 and § 97-93.

If your direct employer isn’t insured, the principal contractor may be liable under N.C. Gen. Stat. § 97-19. That statute was written to protect workers like you when subcontractors try to cut corners or don’t carry required coverage.

Also, if you’ve been labeled an “independent contractor,” you may still qualify as an employee under North Carolina law depending on how much control your employer had over your work. Misclassification is common in tower jobs and can impact your ability to collect benefits, so don’t assume you're excluded without speaking to a Charlotte workers’ compensation attorney.

What If Another Company Caused the Injury?

Now, if another company, not your employer, caused or contributed to the injury (for example, by failing to secure equipment or follow RF safety procedures), you may also have a third-party personal injury claim. In those situations, both claims can move forward at the same time:

- A workers’ compensation claim with your employer’s insurance to cover medical care and partial wage loss

- A personal injury claim against the negligent party to seek compensation for damages workers’ comp doesn’t cover (like pain and suffering or full wage loss)

North Carolina law allows both claims to proceed, but your employer’s insurance company may seek reimbursement called subrogation from your third-party settlement or verdict (N.C. Gen. Stat. § 97-10.2). An attorney can help protect your interests and negotiate that lien so you don’t lose a large portion of your recovery.

These kinds of cases get complicated fast. Between multiple employers, layers of liability, potential misclassification, and insurer subrogation, it’s important to get help early so you don’t miss a step, or leave money on the table.

What to Do if You Suffer a Cell Tower Injury in Charlotte

If you're injured while working on a cell tower, take these steps as soon as you can:

- Report the injury to your employer immediately. This is required under North Carolina General Statutes § 97-22.

- Seek medical care from an authorized provider. The employer or their insurance carrier typically selects the doctor.

- Document everything. This includes where and how the injury occurred, who was on-site, and any communication with supervisors or safety leads.

- Request a copy of your medical records. You’ll need them to prove your injury occurred on the job.

- File a Form 18 with the North Carolina Industrial Commission to start the workers’ compensation process.

Failing to follow these steps can delay or derail your ability to collect benefits.

How North Carolina Workers’ Compensation Works

If you were hurt while performing job duties, you may be eligible to receive workers’ compensation benefits under North Carolina law.

These benefits can include:

- Medical treatment for your injuries

- Temporary total disability (TTD) if you can’t work at all while recovering

- Temporary partial disability (TPD) if you can return to limited work but earn less

- Permanent disability payments if your injury leads to long-term or total loss of function

- Reimbursement for medical expenses and travel related to treatment

- Lost wages, calculated based on your average weekly wages before the injury

Keep in mind that workers’ comp benefits are not automatic. The insurance company will review your injury report, medical records, and employer statements. They may dispute the cause of the injury or argue that your condition isn’t work-related, especially if it involves long-term exposure to RF radiation or repetitive stress injuries.

When the Insurance Company Delays, Disputes, or Denies Your Claim

Once your injury is reported, your employer’s insurance carrier becomes the gatekeeper of your benefits. That carrier assigns an adjuster to review your file and decide whether to accept or deny your claim. But insurance companies don’t make money by paying claims easily.

Even if your injury clearly happened on the job, you may run into:

- Delayed responses or unexplained denials

- Claims that your injury wasn’t reported properly or promptly

- Pressure to return to work before you're medically ready

- Requests for multiple medical exams to dispute your injury

- Disputes over your medical treatment plan

- Refusals to cover follow-up care or specialist visits

- Undervalued average weekly wage calculations

- Allegations of pre-existing conditions

All of this can jeopardize your ability to receive workers’ comp benefits, especially if you’re recovering from a serious injury and don’t have someone advocating for you.

In North Carolina, if your claim is denied, you have the right to request a hearing before the North Carolina Industrial Commission by filing a Form 33. You don’t have to accept the insurance company’s first answer. A workers’ compensation attorney can help you push back and pursue the benefits you're eligible for under the law.

Talk to a Charlotte Workers’ Compensation Attorney About Your Cell Tower Injury

You’ve already taken risks most people wouldn’t. Now that you’re injured, you don’t have to take any more chances with the insurance company.

At Speaks Law Firm, we represent tower workers and other injured employees across Charlotte and North Carolina. Our legal team knows the workers’ compensation system inside and out, and we’re prepared to take on the employer’s insurance carrier to fight for your rights. We also look at every angle of your case, including whether you may be able to file a third-party personal injury claim for maximum compensation.

If the insurance company won’t treat you fairly, our Charlotte workers’ comp lawyers will. Your online search for a “worker comp lawyer near me” brought you here, and you’re in the right place. Take the next step and call (888) 222-1111 or reach out through our secure online form to schedule your FREE case evaluation. We’ll listen, review your case, and talk through your next steps.

While you wait for your FREE consultation, we invite you to check out our podcast, Personal Injury Lawyer Podcast with American Injury Lawyer Clarke Speaks.

Who speaks for you? We do!