Related Services

You never saw it coming. One minute you were driving through Wilmington traffic like any other day, and the next, your car was wrecked, and the driver who hit you had taken off. No exchange of information. No apology. Just damage, debris, and the sinking realization that you might be on your own.

If you’re dealing with a hit-and-run or the driver who caused your accident has little or no insurance, you may be wondering whether your own policy offers any protection. North Carolina uninsured motorist coverage and underinsured motorist coverage are designed for situations like this where the at-fault driver cannot cover your losses. This blog explains what these coverages include, whether they are required in Wilmington, and how they could make a difference in your ability to recover after a serious crash.

Is Uninsured Motorist Coverage Required in North Carolina?

Yes. North Carolina law requires all car insurance policies to include uninsured motorist (UM) coverage. This applies to all private passenger vehicles insured in the state.

As of July 2025, the minimum coverage limits for liability and uninsured motorist insurance are:

- $50,000 for bodily injury per person

- $100,000 for total bodily injury per accident

- $50,000 for property damage

These limits apply to both liability insurance and UM coverage. That means if the driver who caused your crash is uninsured or flees the scene, your own UM coverage will step in up to these limits.

Is Underinsured Motorist Coverage Also Required?

As of July 1, 2025, all new or renewed auto insurance policies in North Carolina regardless of liability limits must now include underinsured motorist (UIM) coverage.

Previously, UIM coverage was only required if you carried more than the old minimum limits ($30,000/$60,000). Now, UIM coverage is included by default in every policy, including those that meet the new minimum limits of $50,000 per person / $100,000 per accident for bodily injury and $50,000 for property damage.

Key changes to UIM coverage under the new law:

- You cannot reject UIM coverage entirely.

- You may request lower UIM limits in writing, but they must still meet the new state minimums.

- A vehicle is now considered "underinsured" based on the total damages sustained, rather than by comparing policy limits alone.

- No liability setoff applies: your UIM benefits are not reduced by the at-fault driver’s liability coverage, meaning you can receive the full amount of UIM compensation on top of what you receive from the other driver’s policy.

- If you're covered under multiple UIM policies, the total available UIM coverage is the combined sum of the highest limits from each policy, without offset except in limited situations like workers’ compensation.

These updates provide stronger protection for injury victims and make UIM a much more powerful tool for financial recovery.

How UM and UIM Coverage Protect Wilmington Accident Victims

After a serious car accident in Wilmington, your uninsured or underinsured motorist coverage can provide a financial safety net when the other driver cannot. These policies can help you:

- Pay for emergency room visits and surgeries

- Cover physical therapy and long-term care

- Recover lost wages and reduced future earnings

- Compensate for pain, emotional distress, and suffering

- Repair or replace your damaged vehicle

These coverages are part of personal injury law, and you still need to prove that the other driver caused the accident. If the insurance company can argue that you were even slightly at fault, they may try to deny the claim.

What If You Were Partially at Fault for the Accident?

North Carolina follows a strict contributory negligence rule. If you are found to be even 1% at fault, you may be barred from recovering compensation, even from your own underinsured motorist coverage.

Insurance companies often use this rule to avoid paying claims. Common tactics include arguing that:

- You were driving slightly over the speed limit

- You failed to yield properly

- You were distracted at the moment of impact

That is why many injury victims in Wilmington choose to work with personal injury lawyers who can gather evidence, interview witnesses, and challenge blame-shifting tactics by the insurance company.

Why UM/UIM Matters in Wilmington

With its mix of locals, college students, and out-of-town visitors, Wilmington’s roads can be unpredictable. Whether you're driving downtown near the courthouse, commuting along College Road, or heading to Wrightsville Beach, you are sharing the road with people who may not carry enough insurance, or any at all.

North Carolina has one of the highest uninsured driver rates in the region (10.3% to 13%), and Wilmington sees an influx of seasonal drivers who may carry only minimum limits. UM and UIM coverage protect you in these situations and help you recover when the at-fault driver cannot pay.

How Much Uninsured or Underinsured Coverage Should You Have?

While $50,000 per person / $100,000 per accident / $50,000 property damage is now required in North Carolina, many drivers choose to carry higher limits. A serious crash can leave you with more than $100,000 in medical bills alone, especially if you need surgery or extended treatment.

Here are some tips:

- Match your UM/UIM limits to your liability coverage

- Choose higher limits if you commute or support dependents

- Add property damage coverage if your car is newer or high-value

- Review your policy annually to adjust for rising costs

These coverages are relatively inexpensive and can make a major difference in your recovery if you are hit by someone with little or no insurance.

Does UM/UIM Coverage Apply to Pedestrians and Cyclists?

Yes. UM and UIM coverage follow you, not just your vehicle. If you are hit by a car while walking, jogging, or biking in Wilmington, your own UM/UIM policy may apply—even if you were not inside a vehicle.

This protection can help cover your medical expenses, lost wages, and other losses, just as it would if you had been driving.

Wilmington Accidents Where UM/UIM Coverage Helps

Still wondering when this type of coverage actually matters? Here are a few examples that are common in Wilmington:

- You’re rear-ended in a hit-and-run while parked near Front Street. Your UM coverage helps pay for repairs and medical treatment.

- A tourist driver causes a crash near Wrightsville Beach but only carries minimum coverage. Your UIM kicks in to cover $75,000 in uncovered medical bills.

- You’re walking across a marked crosswalk when a distracted driver hits you. Even though you were not in your vehicle, your own UM policy covers your injuries.

These scenarios show just how valuable UM and UIM coverage can be when the unexpected happens.

How Long Do You Have to File a UM or UIM Claim?

You generally have three years from the date of the crash to file a personal injury lawsuit in North Carolina. However, your insurance company may impose much shorter deadlines for notifying them about a UM or UIM claim.

Some policies require that you:

- Notify the company within 30 days of the accident

- Cooperate with an internal investigation

- Submit medical records and other documentation

Missing these deadlines can jeopardize your ability to recover compensation, even if the accident was not your fault. If you are unsure what your policy requires, talk to a car accident attorney in Wilmington as soon as possible.

What Is Uninsured Motorist Property Damage Coverage?

In addition to bodily injury coverage, North Carolina drivers can carry uninsured motorist property damage (UMPD) coverage. This helps pay for vehicle repairs after a crash caused by an uninsured driver or a hit-and-run.

UMPD is not automatically included. You must elect this coverage if you do not have collision coverage. If you do not have either, you may need to pay out of pocket to fix your car, even if the other driver was clearly at fault and had no insurance.

Can You Sue an Uninsured Driver?

Yes, but suing an uninsured driver often does not result in financial compensation. Most drivers without insurance also lack the assets or income to pay a court judgment.

Your best option is often to file a UM or UIM claim through your own insurance. However, if the driver acted with gross negligence, such as drunk driving, you may be able to pursue punitive damages as well.

Punitive damages in North Carolina are governed by N.C. Gen. Stat. § 1D-15.

What to Do After a Wilmington Car Accident With an Uninsured Driver

If you were involved in a car accident and suspect the other driver lacks proper insurance coverage:

- Call 911 and file a police report

- Seek medical treatment and save all records

- Notify your insurance company promptly

- Document the scene and speak with witnesses if possible

- Talk to a personal injury attorney before accepting any settlement

Accidents involving uninsured drivers often require extra steps to recover compensation, especially when dealing with a hit-and-run or denied claim.

Why Wilmington Car Accident Victims Turn to a Car Accident Injury Law Firm

Even when dealing with your own insurer, it can feel like a fight. Insurance companies often try to reduce or deny claims, especially in cases involving UM or UIM coverage. They may:

- Dispute the severity of your injuries

- Request excessive documentation

- Delay processing your claim

- Argue that you were partially at fault

A personal injury lawyer in Wilmington can gather evidence, negotiate with the insurance adjuster, and guide you through each step of your personal injury claim. Most law firms offer representation on a contingency fee basis, meaning you do not pay unless they recover compensation for you.

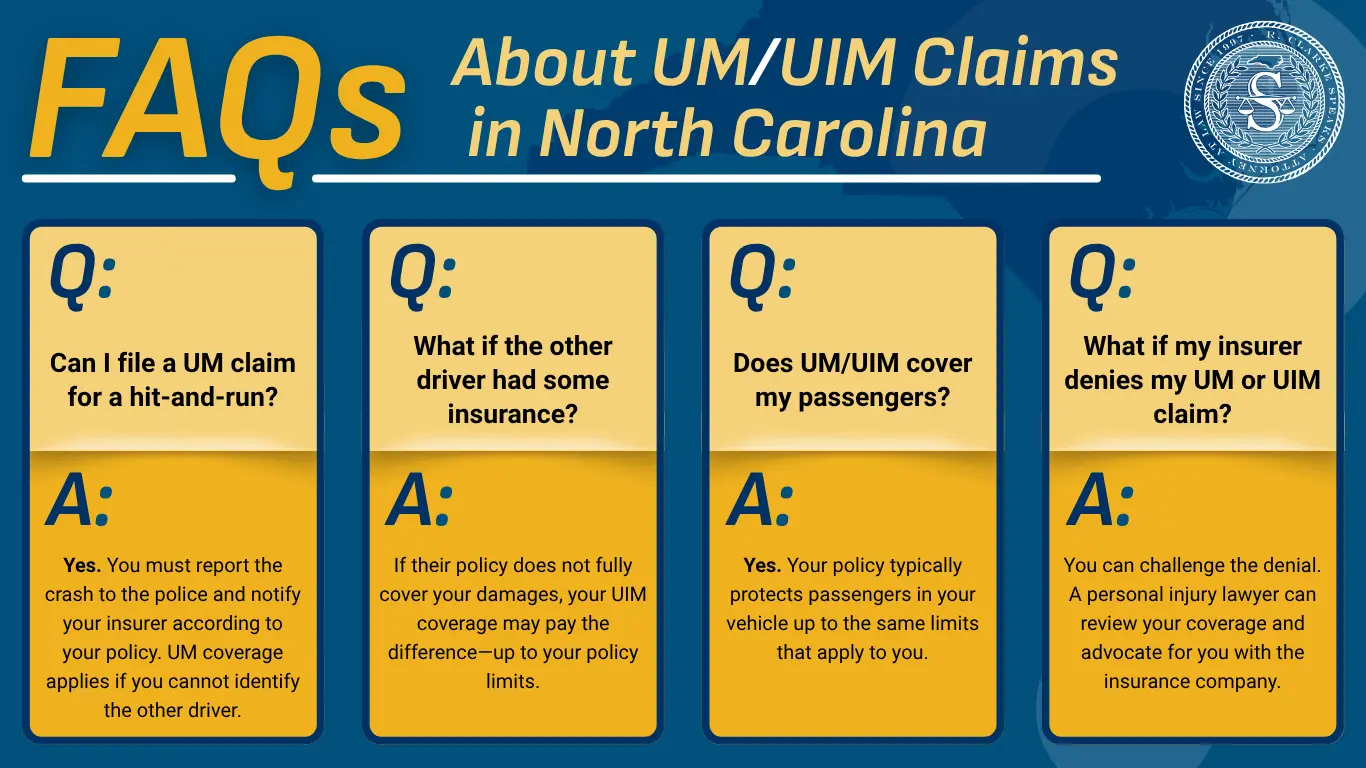

FAQs About UM/UIM Claims in North Carolina

Q: Can I file a UM claim for a hit-and-run?

A: Yes. You must report the crash to the police and notify your insurer according to your policy. UM coverage applies if you cannot identify the other driver.

Q: What if the other driver had some insurance?

If their policy does not fully cover your damages, your UIM coverage may pay the difference—up to your policy limits.

Q: Does UM/UIM cover my passengers?

Yes. Your policy typically protects passengers in your vehicle up to the same limits that apply to you.

Q: What if my insurer denies my UM or UIM claim?

You can challenge the denial. A personal injury lawyer can review your coverage and advocate for you with the insurance company.

Hit by an Uninsured or Underinsured Driver? Speak with a Wilmington Injury Lawyer Today

Getting struck by a driver who has no insurance or not enough insurance, can leave you facing unexpected medical bills, car repairs, and lost income. But you may have more coverage than you think.

At Speaks Law Firm, one of the trusted personal injury law firms in Wilmington, we help people use their own uninsured and underinsured motorist coverage to recover compensation after serious crashes. In some cases, such as hit-and-runs or reckless driving, you may also have grounds for a personal injury lawsuit, and we’re prepared to take that step when it makes sense for your case.

If you’ve been searching for “car accident lawyers near me,” we’re here to explain your options and take on the insurance company for you. Our legal team knows how UM and UIM claims work, how to deal with denied coverage, and how to challenge unfair blame under North Carolina’s contributory negligence rule.

Call (910) 341-7570 or complete our confidential online form to schedule your FREE case evaluation. We’ll review your case and help you take the next step without pressure and without upfront costs.

While you wait for your FREE consultation, we invite you to check out our podcast, Personal Injury Lawyer Podcast with American Injury Lawyer Clarke Speaks.

Who speaks for you? We do!

Related Media

Related Services